The Hippo New Homes Insights Report

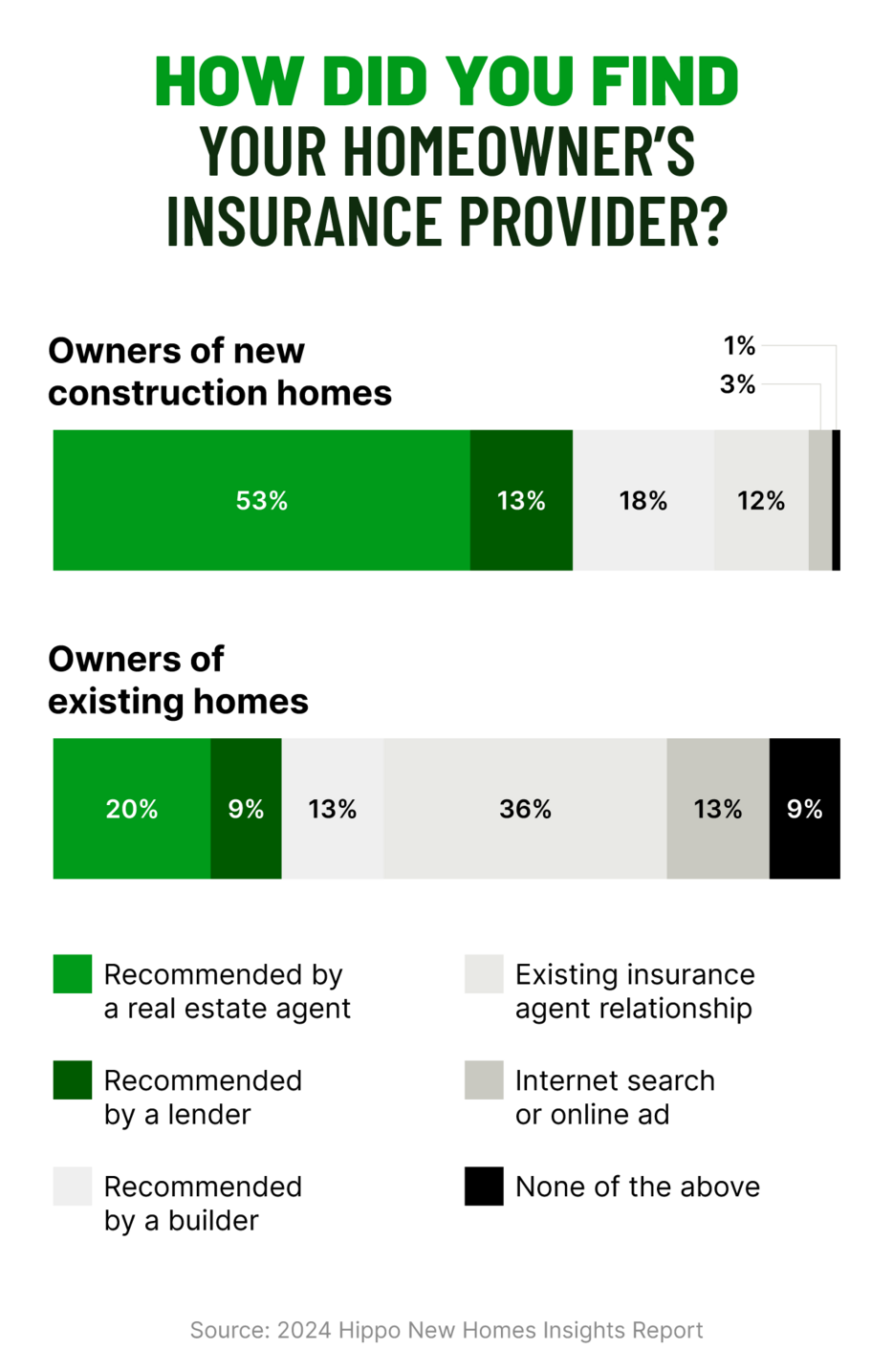

When choosing homeowner’s insurance, new construction buyers and owners of existing homes take surprisingly different paths.

Our latest survey of over 2,000 U.S. homeowners reveals that new construction homeowners are likely to trust real estate agents and home builders for insurance recommendations. In contrast, owners of existing homes are more likely to lean on established relationships with insurance agents or explore a wider range of options.

Despite these differences, one thing is clear: Homeowners are cautious, with many comparing multiple providers before making their final decision. Below, we dive into these findings as we explore the evolving home insurance landscape.

Key takeaways

- Real estate agents and builders play a crucial role in new construction insurance decisions, with 53% of new construction homeowners relying on real estate agents and 18% trusting their builder’s recommendation.

- New construction homeowners are willing to reinvest insurance savings into builder upgrades or customizations, with 92% indicating they would use savings for home additions or enhancements—creating a clear benefit for builders.

- New home builders have a unique opportunity to add value for their customers by partnering with providers like Hippo. Hippo specializes in new construction insurance, streamlining the process for homebuilders. Hippo and its carrier partners can offer policies for new homes with premiums as much as 69% lower in California, 42% lower in Florida, and 56% lower in Texas than policies for an existing home.

The dominant force driving how nearly half of homebuyers choose insurance providers

How builders influence home insurance choices

How thoroughly do homebuyers research insurance providers?

- Brand reputation (45%)

- Total premium (44%)

- Recommendations (43%)

- Discounts (42%)

- Coverage options (42%)

Homeowners can save on new construction insurance—here’s how they’d like to reinvest

We asked over 2,000 U.S. homeowners what they would do if they earned $900 in new construction insurance savings—and for some, this is more than a hypothetical question. Those looking to buy a newly built home could save up to $900 on new home insurance when using a provider with new home specific offerings, like Hippo. But how would they reinvest these savings?

A win-win for home builders and buyers

Methodology

Related Articles

Hippo Expands Home Builder Access to New Homes Program in California, Florida and Texas

Building for the Future: How Residential Construction is Adapting to Weather and Climate Change

Even with Lower Interest Rates, Homebuyers May Still Face Challenges

Master-Planned Communities: The Perfect Fit for Embedded Insurance

Simplifying Loan Officer Workflows with Embedded Insurance