The Hidden Cost of DIY: 58% of Homeowners Blow Their Budget

The expenses of owning a home extend far beyond the initial down payment. According to our 2024 Financial Goals Report, a staggering 86% of U.S. homeowners have sacrificed something in their lives to prioritize homeownership costs.

Additionally, our Homeowner Preparedness Report revealed that nearly half (41%) of surveyed homeowners plan to handle renovation, repair, and maintenance tasks themselves to help manage these costs. But how do you know when it’s more economical to do it yourself (DIY) or when to hire a professional?

We surveyed over 1,700 U.S. homeowners to reveal common pitfalls and to help ensure your next project is an unmitigated success—not an unexpected expense.

Key takeaways

- More than half (58%) of responding homeowners spent more than anticipated on DIY projects due to errors. This highlights the often-overlooked costs of self-execution and underscores the importance of thorough planning and budgeting to avoid financial strain.

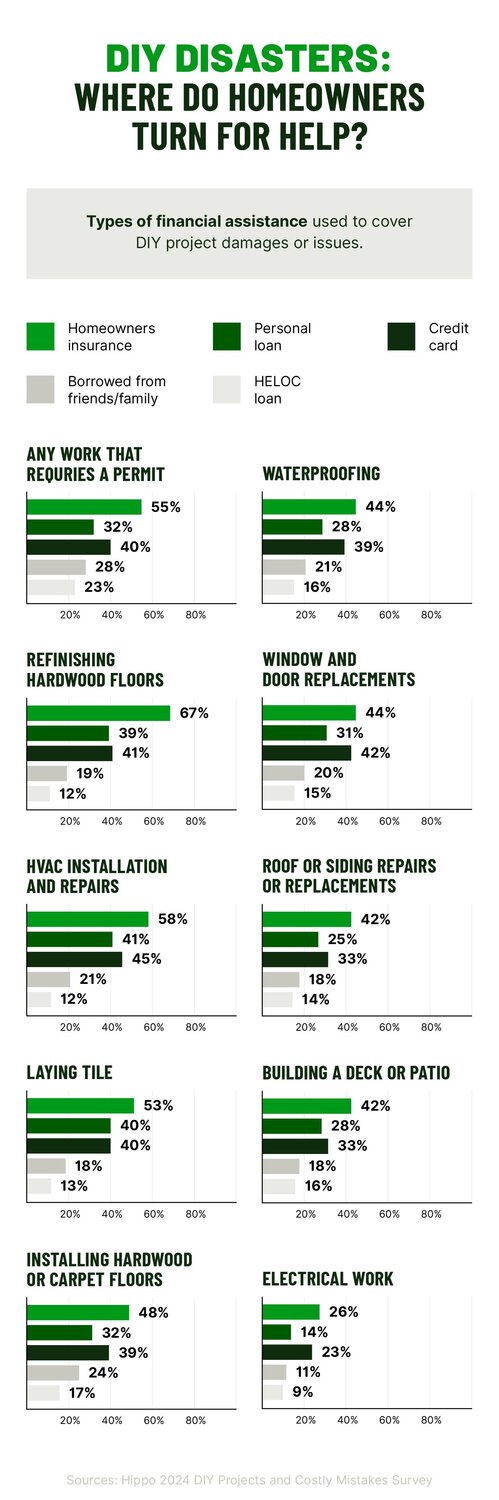

- 54% of respondents experienced financial issues during their DIY projects that were significant enough to require financial assistance. Additionally, 38% of those who faced damage from DIY mistakes ended up paying $500 or more in repairs, emphasizing the financial risks associated with DIY endeavors.

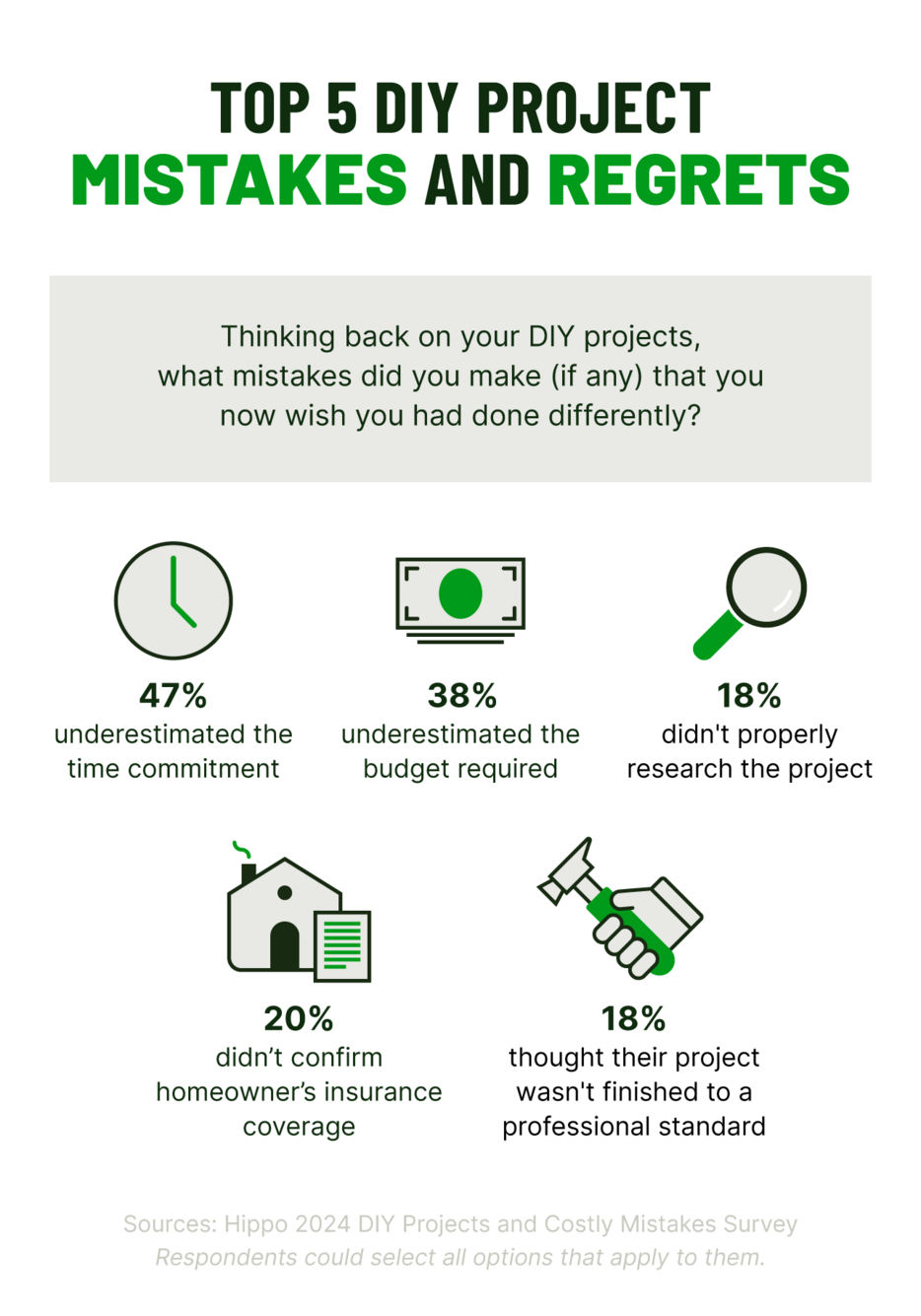

- Many DIYers (47%) underestimated the time commitment required, while 38% did not accurately budget for their projects. These miscalculations can lead to unexpected costs and project delays, making careful planning crucial for a successful DIY experience.

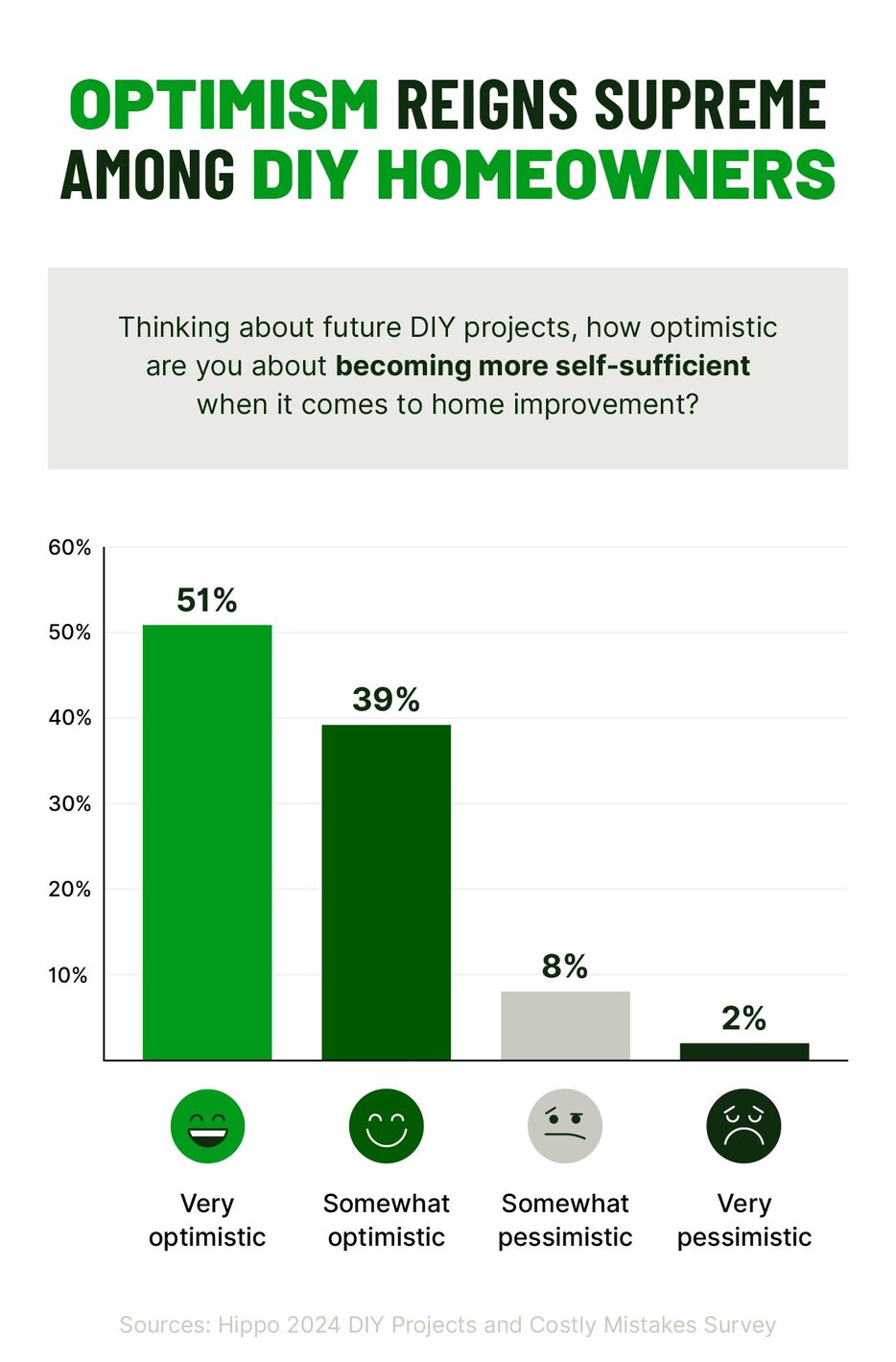

- Despite the challenges and financial pitfalls, 51% of homeowners remain "very optimistic" about their DIY capabilities. This positive outlook, even after setbacks, highlights the potential for DIY project success with the right preparation.

Cost-saving or just costly? The financial impact of DIY projects

54% of DIY homeowners seek financial aid after botched projects

51% of respondents are “very optimistic” about future DIY projects–despite setbacks