Hippo Housepower Report: Home Protection Priorities in 2025

At Hippo, we help homeowners across the U.S. protect their most significant financial asset—their homes. Our annual Housepower Report surveyed over 2,000 U.S. homeowners to uncover valuable insights, from the repairs impacting their financial well-being to their top home projects for the coming year.

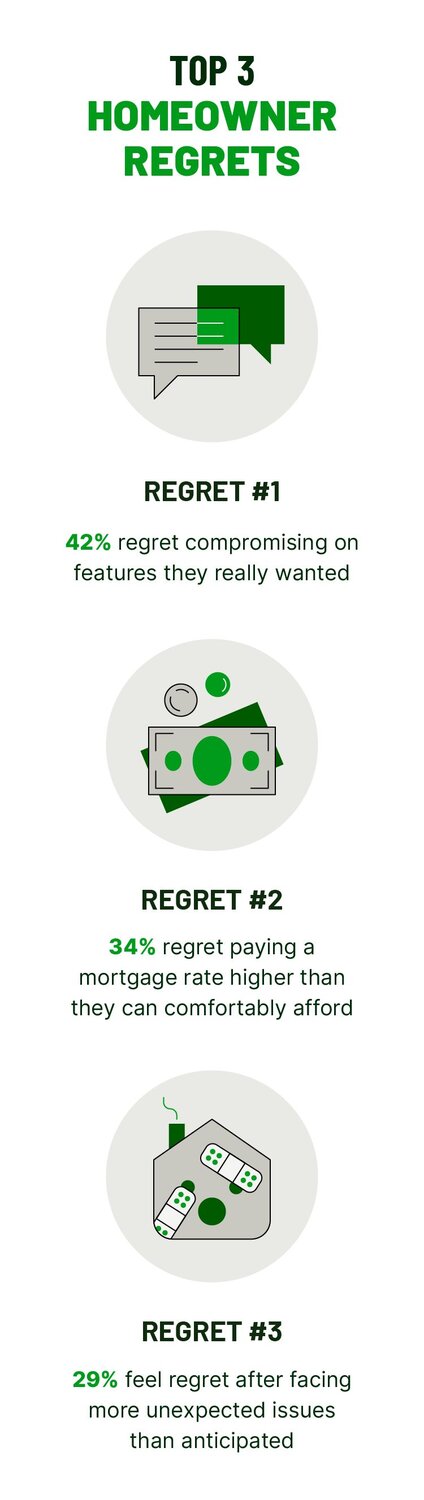

In 2024, many homeowners benefited from building home equity as homeownership remains a leading accumulator of wealth. However, this year also brought financial challenges for homeowners when protecting their investment, including historically high mortgage rates, rising insurance premiums, and unexpected maintenance costs.

Looking ahead, homeowners are taking on new strategies to protect their homes and finances. Nearly half (47%) are creating an emergency plan for 2025, 42% are reviewing their home insurance, and 30% are exploring additional coverage. Preventative DIY projects and energy efficiency improvements are also high on their lists.

After a costly 2024, homeowners can take control by committing to home improvement and protection in the year ahead. In fact, over 90% of homeowners say they already have home projects planned for 2025, reflecting a clear path towards creating enduring properties for the future.

Key takeaways

- Our annual Housepower Report survey found 46% of homeowners spent over $5,000 out-of-pocket on unexpected home repairs in 2024, a significant increase from 36% in 2023. This highlights the rising financial burden of unforeseen home maintenance costs.

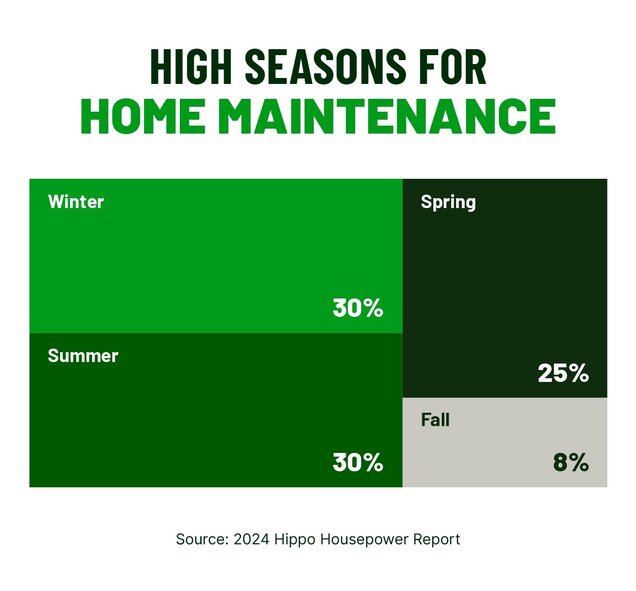

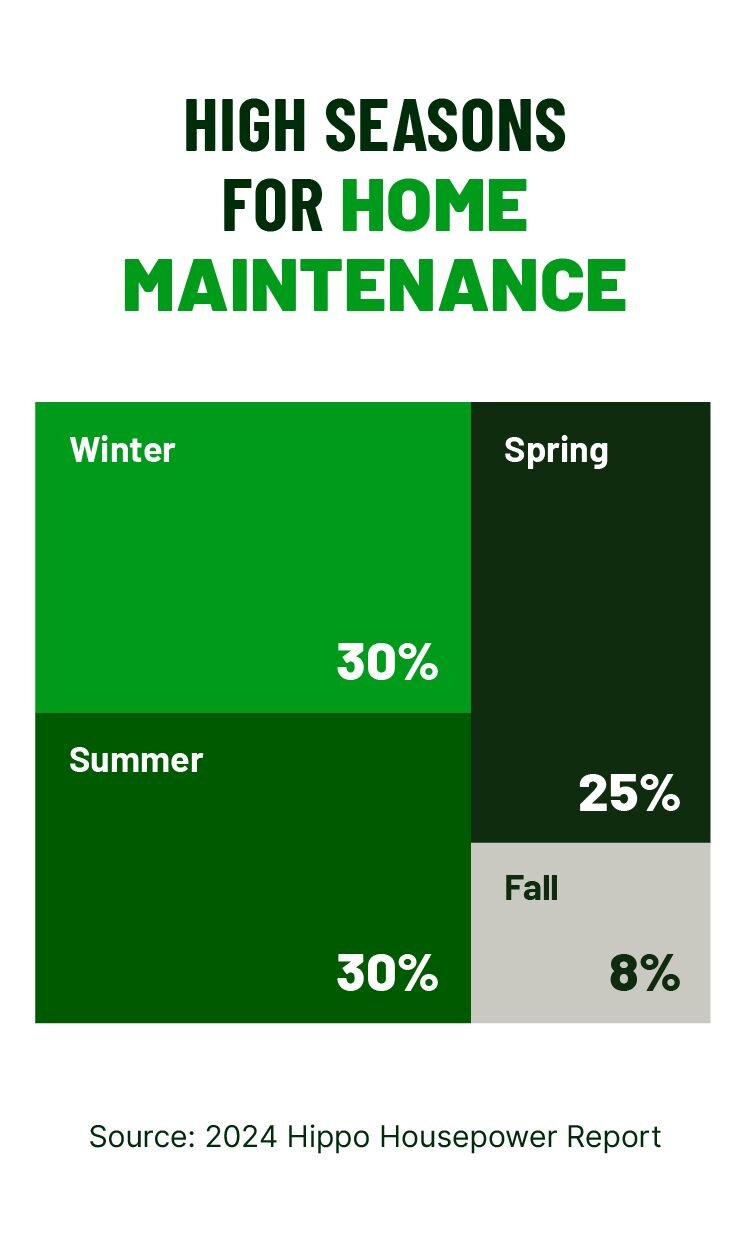

- Nearly a quarter (24%) of homeowners spent less than $1,000 for all seasonal home maintenance tasks in 2024, the most common amount spent by respondents.

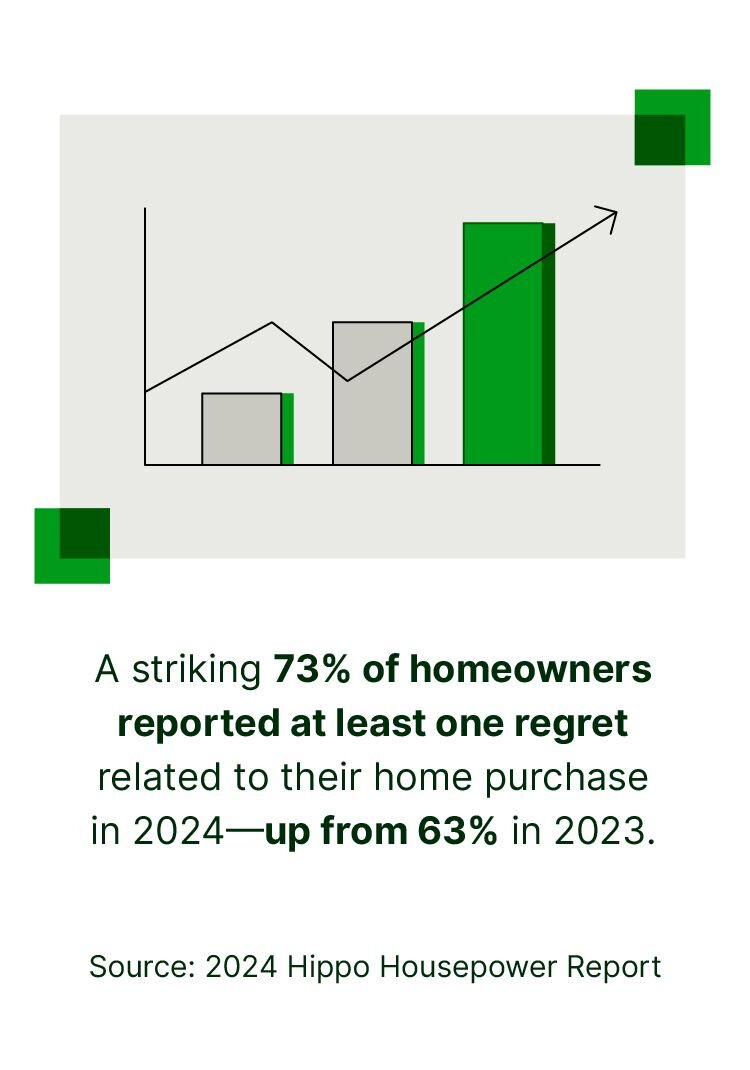

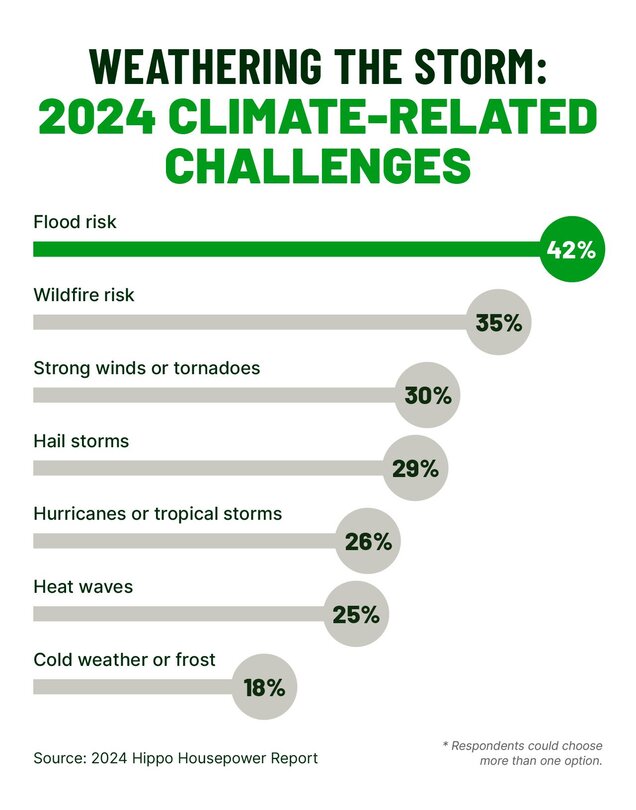

- A significant 73% of homeowners expressed regret about their home purchase in 2024, primarily due to compromises on features, higher-than-expected mortgage rates, and unexpected maintenance issues. This is up from 63% in 2023, indicating a troubling year-over-year trend.

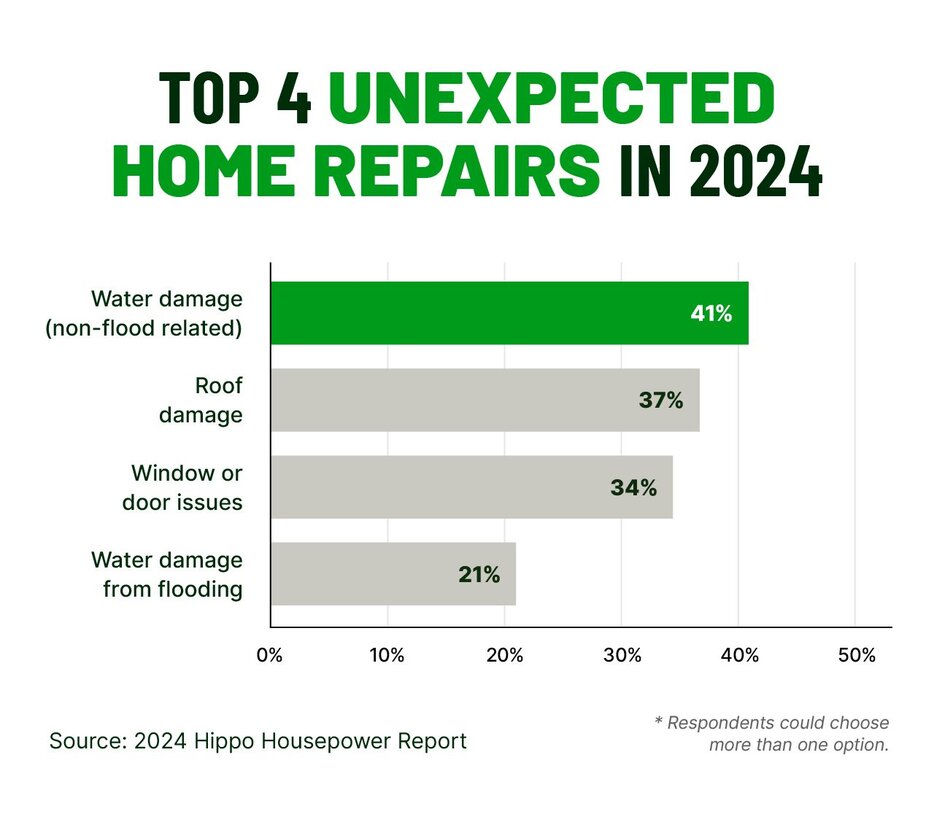

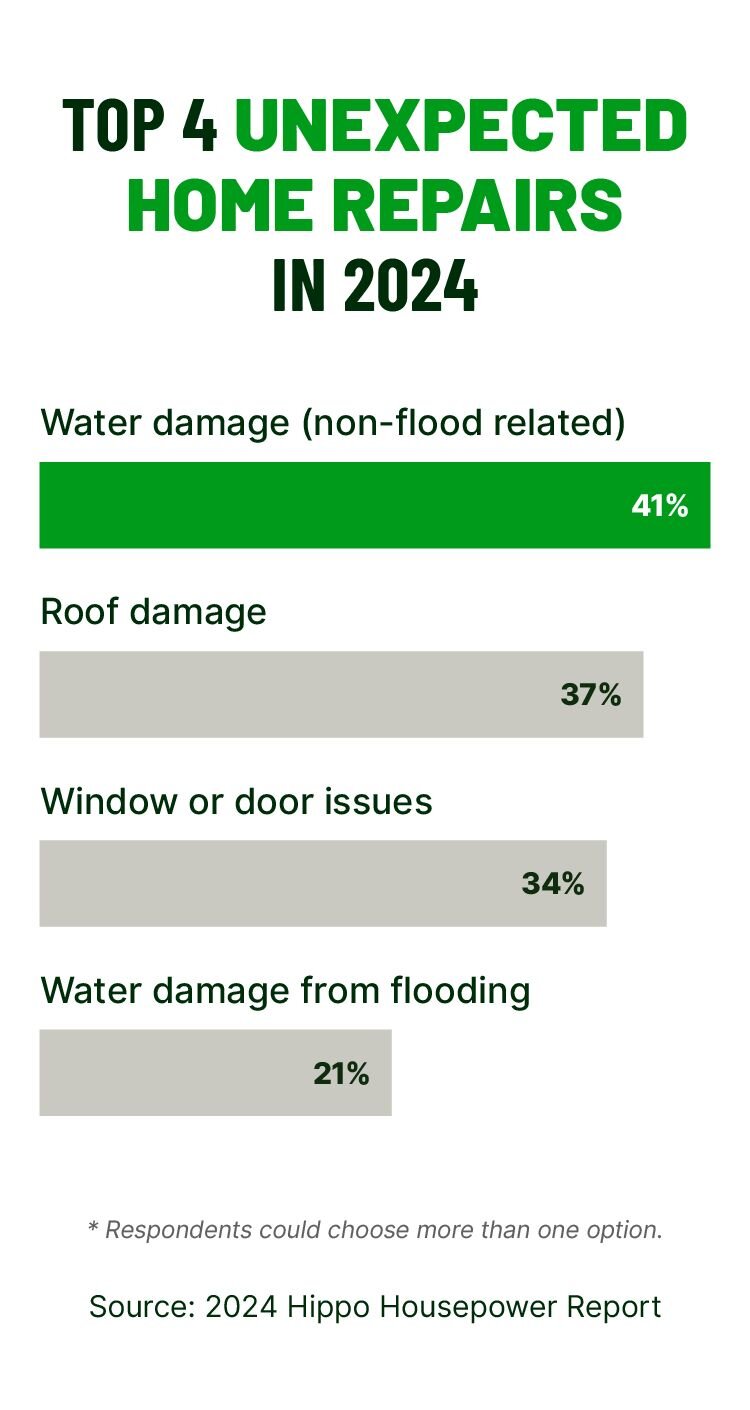

- Unexpected maintenance issues affected 83% of homeowners in 2024 compared to 46% in 2023. Water damage, roof damage, and window or door issues were the most common problem areas.

- DIY surges in response to rising costs, with 55% of homeowners planning to take on more DIY projects in 2025.

- Driven by environmental concerns and cost-saving opportunities, 59% of homeowners will prioritize energy efficiency and sustainability in 2025.

- Nearly half (46%) of homeowners reported home insurance and protection plans as a top priority, highlighting the importance of safeguarding their home investment against unexpected events.

Balancing home protection spending amid rising repair costs

- 64% prioritized maintenance to preserve their home’s overall condition.

- 46% completed tasks to protect or enhance their return on investment (ROI).

- 45% sought to prevent costly damages.

Lessons from 2024: Navigating unexpected home repairs

Remorse re-surges in 2024: Top homeowner regrets revealed

Regret #1: Compromising on desired home features

Regret #2: Shouldering oppressive mortgage rates

Regret #3: Battling unexpected issues and repairs

Motivations for preventative maintenance by age groups

Younger homeowners: Focused on protection and prevention

Mature homeowners: Prioritizing ROI and long-term stability

Homeownership in 2025: Priorities for the year ahead

Energy efficiency and sustainability

DIY home maintenance

Home insurance and protection plans

Homeowner priorities continued

A roadmap to empowered homeownership

Methodology

Related Articles

Hippo’s Annual Housepower Report

2022 Hippo Housepower Report: How Homeowners are Responding to Essential Maintenance During a Shifting Economy

Hippo 2021 Homeownership Report: Modern Misconceptions of Homeownership

Unlocking the American Dream: 2024 Financial Goals Report

Hippo 2023 Homeowner Preparedness Pulse Report