Master-Planned Communities: Perks, Costs, and Insurance Coverage

Master-planned communities (MPCs) are taking neighborhood design into the modern age. Unlike traditional developments, where homes and amenities evolve over time, MPCs are built with a clear vision from day one.

A key advantage of MPCs is their ability to deliver move-in-ready homes—an important factor for nearly a quarter of U.S. homeowners, according to our upcoming American Dream Homes survey. With thoughtfully planned communities, modern amenities, and turnkey properties, MPCs offer an experience that aligns with what many buyers want.

In this article, we’ll break down the pros and cons of MPCs, examine their impact on home insurance, and highlight examples of the most impressive master-planned communities from the past year.

Beyond housing: The appeal of MPCs

- Resort-style pools

- Spacious backyards

- Fitness centers

- Nature trails

- On-site retail

- Smart home infrastructure

- Private security

- Homeowners’ associations (HOAs)

Benefits and challenges of master-planned communities

MPC BENEFITS | MPC CHALLENGES |

|---|---|

More predictable investment returns, even in fluctuating markets. | Rising lot prices can impact affordability and profitability. |

Amenities and design guidelines create a desirable living environment, attract buyers, increase demand, and reduce sales cycles. | Developers must stay ahead of trends to maintain appeal, especially in the early phases of the community. |

Many MPCs prioritize climate resilient features (e.g., earthquake- or fire-resistant home designs) which can help reduce insurance claims and improve home longevity and value. | Large-scale MPCs can take years to complete, requiring builders to commit resources for extended periods. |

Efficient land use and pre-planned utilities simplify development and reduce risk. | Builders must adhere to the MPC’s architectural and aesthetic standards. |

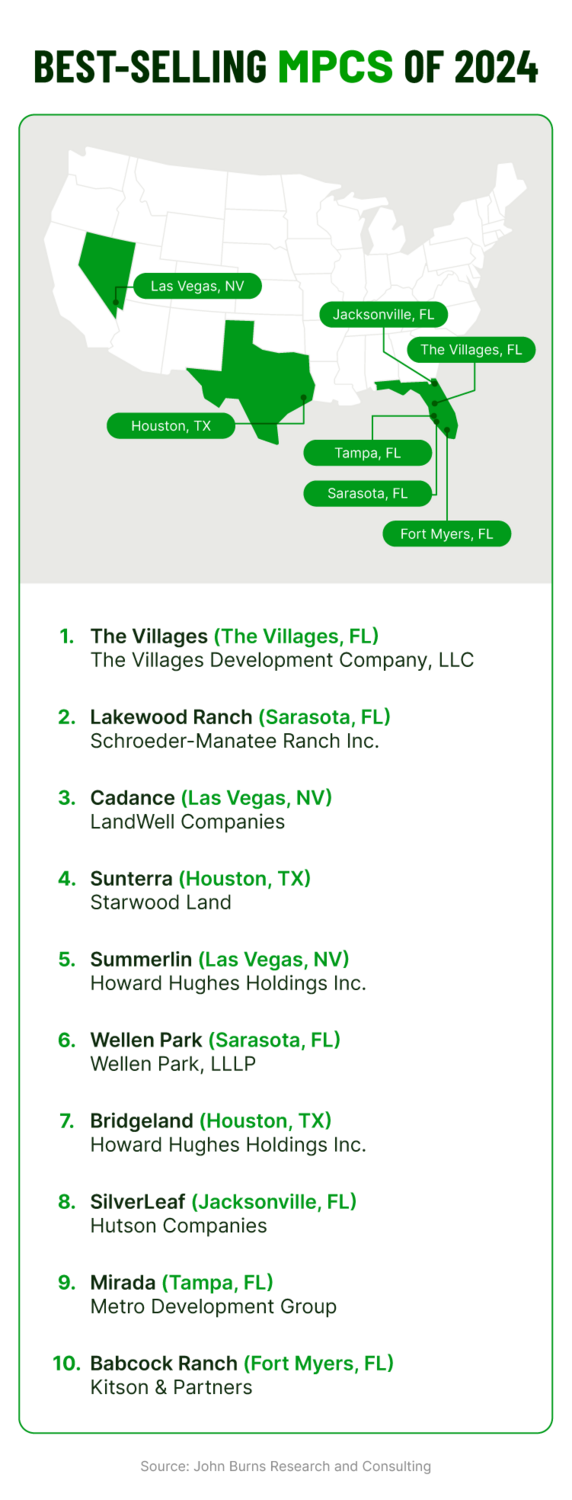

Best-selling master-planned communities of 2024

PROJECT NAME & LOCATION | DEVELOPER NAME | PROJECT SIZE |

|---|---|---|

1. The Villages, FL | The Villages Development Company, LLC | 35,000 acres |

2. Lakewood Ranch, FL | Schroeder-Manatee Ranch, Inc. | 33,000+ acres |

3. Cadence, NV | LandWell Companies | 2,200 acres |

4. Sunterra, TX | Starwood Land | 2,303 acres |

5. Summerlin, NV | Howard Hughes Holdings, Inc. | 22,500 acres |

6. Wellen Park, FL | Wellen Park, LLLP | 11,000 acres |

7. Bridgeland, TX | Howard Hughes Holdings, Inc. | 11,500 acres |

8. SilverLeaf, FL | Hutson Companies | 11,000 acres |

9. Mirada, FL | Metro Development Group | 2,000 acres |

10. Babcock Ranch, FL | Kitson & Partners | 18,000 acres |

- Embracing rate buydowns to attract buyers with lower payments. Along with closing cost contributions, some builders also reduced prices on standing inventory to help boost sales.

- Securing a steadier lot supply and more predictable timelines to support consistent sales and deliveries.

- Capitalizing on the lifestyle appeal of MPCs by incorporating high-quality amenities, schools, security, and a variety of housing options that cater to different buyer preferences.

Many of the top master-planned communities are located in traditionally harder-to-insure areas prone to hurricanes or other natural disasters. Despite these risks, their warmer climates and growing workforce help drive the high demand for homes in these regions.

Homeowners insurance for master-planned communities

Next-gen protection for MPCs

Download the key article insights

Related Articles

Master-Planned Communities: The Perfect Fit for Embedded Insurance

Understanding the Modern Homeowner: New Construction vs. Existing Homes

The Hippo New Homes Insights Report

How Hippo Makes New Homeownership More Affordable

Hippo Expands Home Builder Access to New Homes Program in California, Florida and Texas