HO-3 vs HO-5 Homeowners Insurance Policy

Buying homeowners insurance coverage is an important step in protecting one of your biggest assets: your home. The type of policy you need to buy, though, depends on the type of home you own and how much coverage you want on your property.

Two of the most common types of homeowners insurance policies are known as HO-3 and HO-5 policies, each offering homeowners a different level of protection for their dwelling and personal belongings. Read on to learn about HO-3 vs HO-5 policies and how to decide which is right for you.

Key takeaways

-

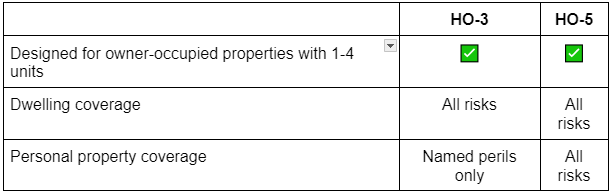

Ho-3 and HO-5 insurance are designed for owner-occupied residences with one to four units.

-

Both HO-3 and HO-5 insurance policies offer all-risk coverage for your dwelling and other covered structures, as well as personal liability protection.

-

While HO-3 insurance provides you with named peril coverage for personal belongings, HO-5 takes this a step further by providing all-risks coverage for personal belongings.

-

Because HO-5 insurance is a bit more comprehensive than HO-3, premiums will generally be higher.

What is the difference between HO-3 and HO-5 insurance policies?

Both HO-3 and HO-5 homeowners insurance policies help you protect both your dwelling and eligible structures, as well as personal belongings you may have in your home. There are some important differences to understand between these two types of homeowners insurance policies, though, so you can ensure that you’re buying the most appropriate and comprehensive insurance coverage for your specific situation.

HO-3 insurance policy

As of 2023, HO-3 insurance policies are the most commonly issued type of homeowners coverage in the United States. It is designed for owner-occupied dwellings with four or fewer units, such as single-family homes, duplexes, triplexes, and even quadplexes.

HO-3 insurance policies provide “all risk” coverage for your dwelling. This means that your buildings — including your primary home, an attached garage, and other eligible structures like a shed or gazebo— are covered against any risks (also known as perils) that aren’t specifically named in your policy as an exclusion.

Covered perils typically include things like:

-

Fire

-

Lightning

-

Windstorms

-

Hail

-

Smoke

-

Explosions

-

Vandalism

-

Theft

-

Riots

-

Volcanic eruptions

-

Falling objects

-

Weight of ice, snow, or sleep

-

Accidental discharge or overflow of water or steam from within a plumbing, heating, air conditioning, or automatic fire-protective sprinkler system, or from a household appliance

HO-3 insurance also provides coverage for your personal belongings if damaged by select named perils. This protection includes items like your clothes, furniture, home decor, and other household goods.

Your belongings are usually covered by value up to a percentage of your dwelling coverage limit, often between 50% and 70%. This means that if your property coverage limit is $600,000, your personal belongings may be protected for between $300,000 and $420,000. However, this varies based upon carrier and what options you choose.

Lastly, HO-3 insurance provides homeowners with personal liability protection. This provides coverage to pay for claims of bodily injury and property damage sustained by others for which you or covered residents of your household are legally responsible. This means that if another child breaks their arm on your trampoline, your homeowners insurance policy may kick in to cover things like their medical expenses.

HO-5 insurance policy

Like an HO-3 policy, HO-5 insurance is designed for owner-occupied homes with between one and four units. It protects both your dwelling and your personal belongings against all risks, providing you with more personal property protection than an HO-3 policy. It also offers personal liability coverage.

Just as with HO-3 coverage, HO-5 homeowners insurance policies extend to your dwelling and attached structures. Eligible detached structures, such as a garage, fence, tool shed, gazebo, pool house, deck, and more, may also be protected.

Difference between open perils and named perils

When it comes to homeowners insurance coverage, there are two categories of protection that could be involved: open peril and named peril.

-

Open peril means that any type of risk is covered, except those that are specifically excluded

-

Named peril means that you can only claim damages caused by a list of mentioned risks covered by the policy. If the peril isn’t named explicitly, any related damages aren’t considered covered.

This is an important distinction to make, as it helps you understand exactly what your homeowners insurance policy will or will not financially protect against. For example, both HO-3 and HO-5 policies provide all risk or open peril coverage on dwellings, so your home is protected against any risk that isn’t explicitly excluded by your carrier.

When it comes to personal property, HO-3 policies only protect against named perils. This means that if the cause isn’t named explicitly in the policy documents, your belongings aren’t protected against damage if that peril occurs. HO-5 coverage, on the other hand, provides open peril coverage for personal property, so all risks are covered unless explicitly excluded by the policy.

HO-3 and HO-5 coverage exclusions

As mentioned already, both HO-3 and HO-5 policies have open peril dwelling coverage, so your home is protected against any number of hazards. However, there are usually some perils that are not covered by an HO-3 or HO-5 policy and will be named in your coverage documents as insurance exclusions.

These exclusions can vary from carrier to carrier, from one policy to the next, and even depend on the geographic area of the home. Commonly excluded perils include, but are not limited to, floods, tornadoes, earthquakes, mold damage, sewer backups, landslides, etc. Additionally, homeowners insurance coverage always excludes damages and repairs related to normal wear and tear.

You may still be able to buy separate coverage to protect your home against some of these perils, but it will come at an additional cost. If you are in an area prone to certain excluded perils — such as living in a known floodplain or a hurricane-prone coastal town — your coverage options could be both limited and costly.

HO-5 vs HO-3 insurance policy cost

Because HO-5 insurance offers more coverage than HO-3 insurance, it stands to reason that this type of policy generally costs a bit more. And this is indeed the case for most homeowners.

According to recent data from the National Association of Insurance Commissioners (NAIC), the average HO-3 insurance premium countrywide in 2023 was $1,411. That same year, the national average premium for an HO-5 policy ran homeowners $1,538.

Choosing between an HO-3 and an HO-5 homeowners insurance policy

Both HO-3 and HO-5 homeowners insurance policies provide your dwelling with open peril protection, offering you peace of mind and financial coverage for all causes of loss except those explicitly excluded in your policy. So, how do you choose between HO-3 insurance vs HO-5 insurance coverage?

One consideration is how much protection you want for your personal belongings. Since HO-3 insurance only provides named peril personal property coverage, your possessions are only covered if certain losses occur as named in your policy. HO-5 insurance, on the other hand, financially protects your stuff against all perils not named as exclusions.

In order to choose the right one for you, consider the following:

-

Which perils are excluded by your carrier’s HO-3 coverage? Be sure to ask your carrier which named perils are included in your policy so you can determine the risks that are excluded. That will allow you to make informed decisions.

-

Can you afford to replace your belongings on your own? One risk of HO-3 coverage compared to HO-5 insurance is that if a non-covered peril occurs and damages your personal belongings, you’ll be responsible for replacing your belongings at your own expense. Take some inventory of the items in your home and consider how much it would cost you to replace them if an excluded risk occurred damaging your personal belongings.

-

How much are you truly saving by opting for HO-3 coverage instead of HO-5? The difference between the average HO-3 and HO-5 policy premiums in 2023 was only $127, according to NAIC. Ask your insurance agent to provide you with quotes for each type of coverage; you might be surprised to see how much you are (or aren’t) saving by choosing an HO-3 policy.

-

Can you add certain supplemental coverages? If your carrier excludes certain perils like floods, earthquakes, mold, or sewer backups, you might find that you can simply purchase peril specific coverage for these events

Still have questions?

Here are some of the most frequently asked questions regarding HO-3 and HO-5 homeowners insurance coverage.

What is the difference between DP-3 and HO-3?

The biggest difference between DP-3 and HO-3 insurance is that a DP-3 policy is designed for landlords and property owners who don’t use the home as their primary residence. Like an HO-3 policy, DP-3 insurance usually offers dwelling coverage for your structures and personal liability protection. Unlike an HO-3 policy, though, DP-3 doesn’t always cover personal belongings. DP-3 policies usually cover losses at the current replacement cost, too, rather than factoring in depreciation.

What is the difference between all-risk and open peril?

The terms all risk and open peril are often used interchangeably in the world of homeowners insurance. Both allow for coverage of any perils not explicitly named as exclusions within the policy.

What is the difference between HO-2 and HO-5?

Both HO-2 and HO-5 homeowners insurance policies offer standard dwelling coverage for owner-occupied dwellings with one to four units. The difference is that HO-2 policies cover named perils for both the dwelling and personal belongings, while HO-5 is a bit more expansive and offers all-risk coverage for dwellings and personal belongings.

What five risks are generally not covered by home insurance policies?

Each homeowners insurance carrier and policy will have its own covered perils and exclusions. In general, though, there are some risks that no insurance policies generally cover. These include general wear and tear of the home, insect or rodent damage, common maintenance issues, damages due to neglect, and foundation settling. It’s always important to read your policy documents to understand exactly what is and is not covered by your own policy. And, you should always ask your insurance agent any questions you have regarding your policy.

Do I need All Peril coverage?

All peril coverage, also known as an all-risk or open peril, covers any risk not explicitly named as an exclusion by your carrier. This can help protect you and your home against the greatest number of perils and potential events. However, this coverage is generally more expensive than a named peril policy, so it’s important to balance your coverage needs with your budget.