HO-3 vs HO-6 Homeowners Insurance Policy

When shopping around for homeowners insurance coverage, you’ll come across a few different types of policies. Two such policies are known as HO-3 and HO-6, which offer similar coverage but are intended for different property types.

Here’s a look at HO-3 vs HO-6 home insurance policies, what each one offers, and how to decide which is right for you.

Key takeaways

-

HO-3 and HO-6 policies are each a type of homeowners insurance coverage.

-

Both HO-3 and HO-6 offer dwelling coverage to protect a property you own, as well as protect your personal belongings from damage or loss.

-

HO-3 policies are meant for owner-occupied one- to four-unit family homes, while HO-6 is designed for owners who occupy their condo or co-op.

-

Because condominiums are shared buildings, HO-6 coverage generally only protects the portion of the dwelling where you have an insurable interest.

-

When comparing HO-6 vs HO-3 insurance, it’s important to understand what’s required for your specific property.

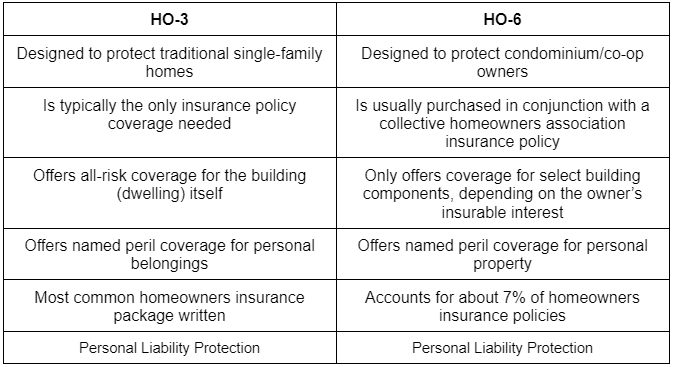

Difference Between HO-3 and HO-6 Insurance Policies

If you own real estate, you will likely want to protect your investment, which means buying homeowners insurance coverage. Two types of homeowners insurance policies you might encounter include HO-3 coverage and HO-6 coverage. While these policies offer many of the same benefits, HO-3 insurance vs HO-6 insurance has some important differences to note.

An HO-3 homeowners insurance policy is intended to protect one- to four- unit family homes that are owner occupied. HO-3 insurance helps protect both the dwelling (house) itself and the personal belongings you have inside. HO-3 policies also provide personal liability protection.

An HO-6 policy, on the other hand, is only written for and issued to owners of condominium and co-op units. Because these units are held within a jointly-owned building, this coverage only protects certain aspects of the dwelling and the owner’s personal belongings. HO-6 policies also generally provide personal liability protection.

Here’s a little bit more about each of these coverage types and the difference between HO-6 and HO-3 policies.

HO-3 insurance policy

As mentioned, HO-3 insurance is a type of homeowners coverage that protects an owner-occupied, one- to four-unit family dwelling where someone both owns and lives on the property. It is designed to provide the homeowner with a wide range of coverage for the asset itself as well as the personal belongings inside. In the case of a covered event, this policy will step in to repair, rebuild, or even replace the home and lost items based upon the terms and conditions of the policy.

HO-3 homeowners insurance is the most common type of coverage and accounts for nearly 55% of all homeowners policies written in the United States. It provides three primary coverages:

-

All-risk coverage for buildings — This includes the primary home and any eligible structures (like an attached garage, shed, fence, etc.). All-risk coverage, also known as open peril, protects against any peril that may occur except for those that are explicitly excluded.

-

Broad named-peril coverage for personal property within the home — This includes things like furniture, clothing, electronics, and more. Named-peril coverage provides coverage for your personal belongings when they are damaged due to specific causes named within the policy.

-

Personal liability protections for the homeowner — This coverage protects the homeowner if the homeowner is found responsible for the bodily injury or property damage of a third party.

Perils are risks or disasters that can result in damage or loss, such as storms, fires, burst water pipes, and more.

The all-risk portion of an HO-3 policy means that the covered dwellings are protected against anything that could occur to the home, whether it be a fire, lightning, hail, wind, smoke, vandalism, explosions, riots, theft, and more. Unless it’s specifically mentioned as an exclusion in the policy, it’s covered.

The named-perils portion of an HO-3 policy means that personal belongings within the home are only protected against perils that are named within the policy documents. This usually includes many of the same standard perils like theft, fire, vandalism, and smoke, to name a few. In many cases, this personal belongings coverage follows your items even if you’re traveling or away from home, though there are often limits for expensive items like jewelry or electronics.

HO-6 insurance policy

An HO-6 insurance policy is designed to offer much of the same peace of mind to someone who owns a condominium or co-op unit within a shared building. Because the building itself isn’t entirely owned by the unit owner(s), these policies specifically cover areas where the condo owner has control and an insurable interest. In many cases, this coverage is purchased in addition to a collective condo owners’ association insurance policy, which protects the shared common areas of the building.

HO-6 coverage also has three primary parts:

-

Named perils coverage for select building items — With condo and co-op insurance, this only includes eligible structures where the owner has an insurable interest, such as parts of an owner’s individual unit. It protects against any risks that are specifically named within the policy. It generally does not protect shared areas like the hallways, a clubhouse, or, in many cases, even the roof or exterior of the building.

-

Named perils coverage for personal property — This includes things like furniture, clothing, electronics, and more. Named-peril coverage protects against losses that may occur as a result of specific causes named within the policy.

-

Liability protections for the homeowner — This coverage protects the homeowner if the homeowner, other occupants of the home, or even the family pet is responsible for the bodily injury or property damage of someone else.

Some HO-6 policies may also offer loss assessment coverage. This can be used to help cover losses in shared areas of the property, such as the pool or lobby. It typically only kicks in when damages exceed the homeowners association’s master policy coverage limits and allows you to share the burden of that coverage with other residents in the building.

Your HO-6 coverage may also include loss of use protection if you’re displaced from your dwelling due to a covered loss and incur additional living expenses. Depending on the specific policy, loss of use coverage can be used for things like hotel stays or a temporary replacement rental property, food, laundry services, and more.

We encourage you to review your policy to determine the exact coverages and exclusions.

Difference between actual cash value and replacement cost value

When buying any homeowners insurance coverage, it’s important to look at not only what assets you’re protecting but also how much protection that coverage offers. There are two coverage categories: actual cash value and replacement cost.

The actual cash value of an item is how much it’s worth today. If a portion of your dwelling is damaged, such as your roof, actual cash value will look at factors such as its age, its condition before the incident occurred, and the materials used to determine what it was worth before it was damaged or destroyed. You’ll then receive this actual cash value (ACV) amount minus any deductibles up to your policy’s coverage limits.

Then there is replacement cost, which doesn’t take depreciation into account but simply calculates how much it would cost to actually replace the item or asset. Regardless of whether your roof is 15 years old, replacement cost coverage will foot the bill for a comparable replacement.

It’s important to consider the payment basis — actual cash value or replacement of both your dwelling coverage and your personal property coverage. Because replacement cost coverage typically pays out more after a covered loss, it can be more expensive than actual cash value coverage. However, replacement cost coverage also helps to ensure that your dwelling and belongings will be replaced or repaired comparable to the property that was damaged, so it’s important to weigh the value of each option.

HO-3 and HO-6 coverage exclusions

While both HO-3 and HO-6 coverage are designed to protect homeowners against a wide range of potential perils, there are always some key insurance exclusions to note. Not all perils or situations are covered, and in some cases, you may even want to buy additional coverage (sometimes in the form of riders or separate coverages) to ensure that you’re as protected as possible.

HO-3 coverage exclusions

HO-3 insurance offers all-risk coverage for eligible dwellings. This means that your home is covered against all perils up to your policy limits as long as the peril isn’t explicitly named as an exclusion in the policy. Common exclusions to this coverage include risks like flood, earthquakes, sewer backups, and mold as well as intentional damage or normal wear and tear on the home.

These policies also offer personal belongings coverage against named perils. This means that if the peril is not specified as a covered risk in the policy documents, it is excluded and there is no coverage under the policy.

HO-6 coverage exclusions

There are a few more exclusions to note with an HO-6 policy than with HO-3 coverage, simply due to the nature of condominiums and co-ops. As a condo or co-op owner, you only own the portion of the building that contains your unit. There are usually shared spaces that are owned by the condo association, so you aren’t responsible for buying individual coverage there.

HO-6 coverage typically doesn’t extend to things like shared roofs, building lobbies, clubhouses, shared pools, gyms, and even fences. Instead, these areas are usually protected by a collective homeowners association policy, which you may need to contribute toward.

For your own space, HO-6 policies offer named-peril coverage for both your dwelling and your personal items. This means that your individual unit, anything attached to it (so your floors, cabinets, installed appliances, etc.), and your belongings are covered against any risks that are named in your policy. Common exclusions include things like earthquakes, floods, mold, sewer backups, intentional damage, and normal wear and tear.

HO-6 vs HO-3 insurance policy cost

The cost of any homeowners insurance policy will depend on a number of personal factors. These include things like:

-

Location

-

Age, condition, size, and layout of your home

-

Materials used in the property’s construction

-

Any upgrades or improvements

-

The amount of coverage purchased

-

Any riders added to the policy

Your premiums can also be affected by previous claims you’ve filed and even your personal credit score.

But what is the difference between an HO-3 and an HO-6 policy in terms of cost? While each of these factors can impact your own homeowners insurance premiums, the average cost of an HO-3 policy nationwide was $1,411 in 2021. For the same time period, the average HO-6 policy premium was $531. However, it’s important to note that condo and co-op owners often need to buy into collective homeowners association policies, too, which can increase your total homeowners insurance premiums for the year.

Choosing between an HO-3 and an HO-6 homeowners insurance policy

Whether you should choose an HO-3 or HO-6 homeowners insurance policy comes entirely down to the type of property you own.

-

HO-3 homeowners policies are designed for owner-occupied dwellings with one to four family units.

-

HO-6 homeowners policies are designed for owners of condominium or co-op units. If you own the entire dwelling, don’t share common space with another owner (or HOA), and the home isn’t classified as a condo or co-op, an HO-6 policy probably isn’t right for you.

Still have questions?

Want to learn more about HO-3 and HO-6 homeowners insurance policies? Here are some of the most frequently asked questions.

What is the main difference between an HO-4 and an HO-6?

The main difference between an HO-4 and HO-6 policy is that HO-4 coverage is designed for tenants. Also known as a renter’s insurance policy, this offers named peril coverage for personal property only and does not cover the dwelling itself. HO-6 policies are designed for owners of condominium and co-op units, providing them with a combination of dwelling and personal belongings coverage.

Which HO form is the most comprehensive?

The most comprehensive type of homeowners insurance coverage is an HO-5 policy. This coverage provides homeowners with all-risk coverage on both their dwelling and personal property. As long as a peril isn’t explicitly named in the policy as an exclusion, any damages or loss will be covered up to the policy’s coverage limits.

Why do insurance companies deny coverage?

Insurance companies may deny coverage claims for a number of reasons. This includes claims related to non-covered perils, failure to cooperate with the insurance carrier, or untimely notice of the claim. Carriers may also deny claims if the loss is related to negligence, suspected fraud, intentional damage, or normal wear and tear. The reasons vary based upon policy and carrier, and these are just examples of why a claim may not be covered.

Which area of your home is not protected by most homeowners insurance?

Some areas of your home may not be covered by a homeowners insurance policy, such as sewer lines, your home’s foundation, or areas of damage due to neglect, pests, or normal wear and tear.

How do I choose a policy?

Choosing the right homeowners policy for you means shopping around for the coverage that best suits your needs. You’ll want to purchase a policy intended for your type of property; some HO policies are meant for owner-occupied homes, while others are meant for tenants or condo/co-op units. You should also look at the coverage limits and covered perils and consider things like premiums and deductibles when narrowing down your selections. Your insurance agent is the best resource for information regarding your coverage options.

In This Article

- Key takeaways

- Difference Between HO-3 and HO-6 Insurance Policies

- HO-3 insurance policy

- HO-6 insurance policy

- Difference between actual cash value and replacement cost value

- HO-3 and HO-6 coverage exclusions

- HO-3 coverage exclusions

- HO-6 coverage exclusions

- HO-6 vs HO-3 insurance policy cost

- Choosing between an HO-3 and an HO-6 homeowners insurance policy

- Still have questions?