Understanding What a Homeowners Insurance Binder Is [Quick Guide]

When purchasing homeowners insurance coverage, it can often take a few days for the policy terms to become finalized and your official coverage documents to be sent over. During that time, however, you might need to provide proof of insurance to a mortgage lender or other legal personnel to purchase a home or prove that you have adequate coverage.

This is where an insurance binder comes into play. A homeowners insurance binder gives you temporary proof of coverage while your formal insurance policy documents are being prepared and can tide you over paperwork-wise, no matter why you need to provide documentation. Read on to see how to buy homeowners insurance, what role insurance binders play in that process, and how to get insurance binders when needed.

Key takeaways

-

An insurance binder provides temporary insurance coverage until a formal policy kicks in at a later date.

-

Depending on the coverage and carrier, binder insurance coverage can often last between 30 and 90 days before expiring.

-

Your insurance company typically issues an insurance binder automatically if there’s a period of time before your primary policy goes into effect.

What is a homeowners insurance binder?

A home insurance binder, by definition, is a set of temporary coverage documents offered to you while your formal insurance policy is being prepared. These documents, often valid for between 30 and 90 days, act as a placeholder and provide evidence of insurance. They can help meet any proof of coverage requirements you encounter before your official policy documents are available.

In most cases, you don’t have to worry about knowing how to get an insurance binder. That’s because your carrier will often issue one automatically if you will be waiting a while for your primary policy to kick in. But you should always confirm and don’t assume.

When do I need one?

Typically, insurance binders are useful when planning to finance a purchase through a lender, but your insurance policy won’t go into effect immediately. This document can help you meet the lender’s coverage requirements in the interim and qualify for the loan you need to complete the purchase while serving as a placeholder until your formal coverage is active.

An insurance binder isn’t necessary if your coverage goes into effect right away and you’re immediately provided with the relevant policy documents. Outside of that, though, some common situations where an insurance binder could come in handy are when you’re:

-

Buying brand-new insurance coverage

-

Financing a new home (or car) purchase

-

Changing coverage and buying homeowners insurance with escrow

-

Purchasing an investment or vacation property and need second home insurance

However, it’s important to note that these binders are only short-term safety nets and aren’t permanent solutions — they’re more like background support, making sure you won’t get yourself in trouble before your insurance carrier provides your formal documents.

Other types of insurance binders

While homeowners insurance binders are perhaps the most common, they aren’t the only ones available. Some other types of insurance binders include:

-

Auto insurance binders

-

Commercial property insurance binders

Whether or not you need an insurance binder in any of these situations depends on the underwriting process, how long it will take for your policy to officially become active, and whether or not you already have existing coverage in place.

What does an insurance binder include?

The actual details included will vary between each carrier, policy, and even the individual insurance binder, meaning that the information listed isn’t set in stone. It can vary with different insurance policies and even between different types of homeowners insurance coverage.

In general, though, the information in an insurance binder may include some combination of the following:

-

Asset being insured (your primary home, vacation property, vehicle, etc.)

-

Named insureds

-

Insurance company name (and any assigned insurance agents)

-

Policy number

-

Insurance term period

-

Liability insurance coverage amount

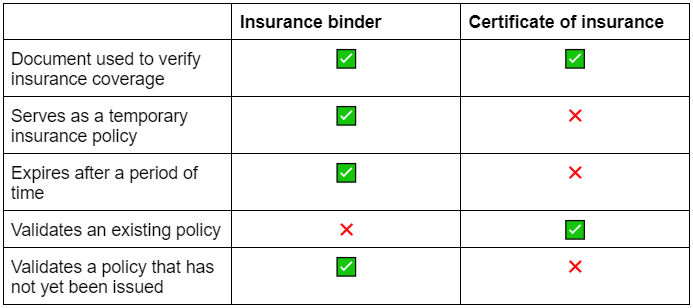

Insurance binder vs. certificate of insurance

Just like a binder for insurance, a certificate of insurance (COI) is another verification document issued by an insurance carrier, which can provide proof of coverage to an interested party. While this is similar to an insurance binder, there are a few important differences to note.

While both an insurance binder and a certificate of insurance can be used to validate insurance coverage, a COI verifies existing policies, while an insurance binder verifies policies that haven’t yet gone into effect. An insurance binder also serves as a temporary coverage in that interim period and expires after a short time (usually between 30 and 90 days). A COI doesn’t provide any individual coverage, nor does it expire.

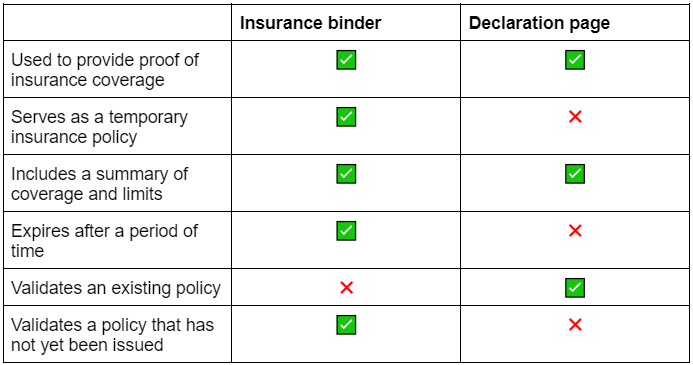

Insurance binder vs. declaration page

An insurance declaration page is another verification document that can be used to identify and summarize insurance coverage. Both include much of the same information, but is an insurance binder the same as a declaration page?

A homeowners insurance declaration page and an insurance binder share many common characteristics and can be used similarly. However, there are many important differences when comparing an insurance binder vs a policy declaration page.

Declaration pages are usually the first page of an insurance policy document packet. This page summarizes the coverage included in that existing policy, such as your coverage dates, policy types, coverage limits, the asset(s) protected, named insureds, and the property address.

While this page can be very useful and provide you with a lot of information at a single glance, it can’t always be used for insurance verification purposes. In some cases, proof of insurance will need to come in another form.

An insurance binder, however, provides temporary coverage until a policy kicks in, usually between 30 and 90 days down the line, at which point it expires and is replaced by the standard policy. This document can be used as proof of coverage and, like a dec page, includes a summary of the types of coverage and limits included.

What if my insurance binder expires?

By design, an insurance policy binder is only valid for a temporary period of time. Once your insurance binder expires, it can no longer serve as proof of insurance and no longer provides you with coverage. It’s important to check with your insurer immediately to confirm that you have active policy coverage in place or, if not, ask how to get an insurance binder.

It’s always best practice to keep tabs on the coverage dates for all of your various insurance policies, including insurance binders. If that date is fast approaching and you haven’t yet received any of your formal policy documents, give your insurance company a call to inquire about a status update. This will help you avoid any lapses in coverage or surprises; once an insurance binder expires, it is no longer valid, and you may be left unprotected.

We all need the peace of mind that insurance protection provides.

Homeowners insurance is one of the many safeguards that can help you in the event of an accident or disaster, offering you peace of mind for one of your biggest and most important assets: your home. Don’t let yourself get caught in a bind — let Hippo provide you with a quote today.

Still have questions?

Here are the answers to some of our most frequently asked questions about insurance binders.

How long does it take to get a homeowners insurance binder?

Depending on the carrier and the coverage being purchased, getting an insurance binder can take anywhere from a few minutes to multiple days. The process of issuing an insurance binder is usually pretty quick, though, allowing you to lock in the temporary coverage you need quickly.

Why do I need an insurance binder to close on a property?

An insurance binder provides you with temporary insurance coverage on an asset, such as a new home, prior to a formal policy going into effect. Having this proof of interim coverage allows a lender to approve the closing process, knowing that the property is protected even before ownership is officially transferred.

Who needs a homeowners insurance binder?

A homeowners insurance binder could be necessary if you’re buying a new home, especially if you are financing a purchase through a lender who requires insurance coverage. This temporary coverage protects you and your newly purchased asset while you’re waiting for your official policy to kick in.

Does a binder end when the policy is issued?

An insurance binder is temporary. The period of time that the insurance binder is necessary and valid can vary but is often anywhere from a few days to 90 days in length. The binder also ends when the policy is issued.

How long is a binder good for?

Insurance binders expire after a specific period of time and are usually only good for up to 90 days. The term of your insurance binder will depend on the coverage purchased, your insurance carrier, and how long you have before your formal policy is issued and coverage goes into effect. You should always check your binder for the expiration date.