What Is a Homeowners Insurance Declaration Page?

Homeowners are often faced with insurance jargon when shopping for and purchasing a home insurance policy. While your insurance agent can help walk you through the process and answer questions you may have, it’s also important to understand what you’re buying and how it affects your premiums, which is where your insurance declaration page comes into play.

So, what is an insurance declaration page? Read on to learn more about this key document, what it entails, and what to look for when you receive your policy confirmation and have a chance to review this important first page.

Key takeaways

-

A homeowners insurance declaration page is a quick-view summary page of your policy, which your carrier provides when you update or purchase a home insurance policy.

-

The declaration page includes important information such as your address, length of coverage, deductibles, and any endorsements.

-

Your declaration page will not list certain details of the policy, such as specific exclusions for each category of coverage or the full policy application.

Homeowners insurance declaration page explained

Your homeowners declaration page, or “dec page,” is a quick breakdown of your policy that your insurer provides when you update or purchase a home insurance policy. It includes important information about your policy, such as your address, the policy period, deductibles, and any endorsements.

This summary helps you quickly confirm what coverage you have, as well as see anything that changes from one year to the next. Be sure to keep your declaration page in a safe place so you can refer to it if you ever need to file a claim or even show proof of insurance elsewhere.

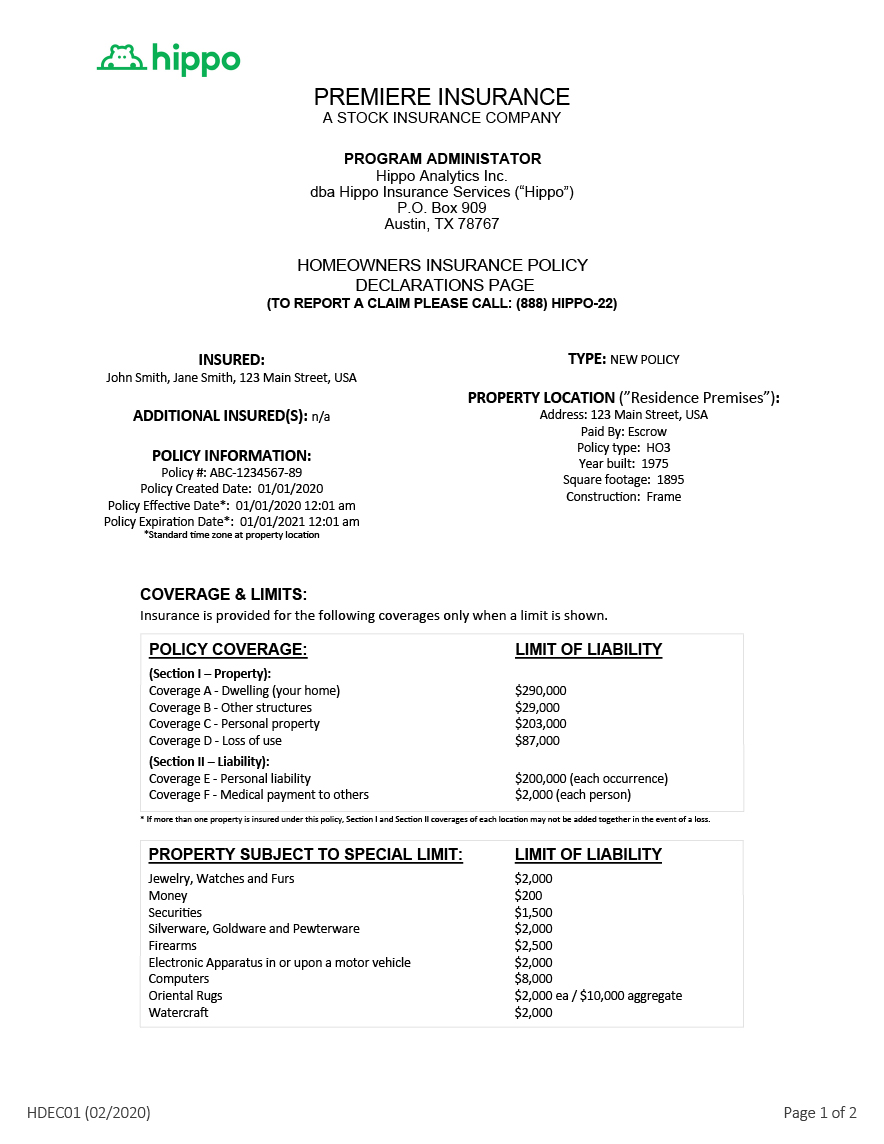

What does a homeowners insurance declaration page look like? Check out an example below.

Why do you need it?

The declaration page of an insurance policy packet is a summary that gives you important information you need about your coverage. While the rest of your coverage packet will delve into this information further, explaining exactly what your coverage entails and how, the declaration of insurance page does a great job of giving you a summary of information at a single glance.

Without needing to sift through multiple pages to find the detailed information you need, your home insurance declaration page will tell you your policy term, which coverages you have, what your coverage limits are, who and what is insured, and how much your premiums are for that policy period.

How to read your home insurance policy declarations: A breakdown

As mentioned, your homeowners insurance dec page is intended to provide you with proof of homeowners insurance as well as be a summary page for easy review, so knowing what you can expect to see on this document (and why) can help you navigate it quickly.

Whether you’re refinancing your home or applying for your first mortgage, understanding the ins and outs of your declaration page can serve you well in the long run. Here’s a look at what it includes.

Policy information

Perhaps the area of your homeowners insurance (HOI) declaration page that you’ll refer to most often is the policy information section. This part includes all of the most basic information you need to know about your policy and where the coverage applies.

This includes your:

-

Policy number

-

Property address

-

Effective dates of coverage (start and end date of the policy)

-

Contact information for filing a claim

-

Premium (and whether those are paid through escrow)

The policy information section may list your lender and their contact information, as well, since your insurance provider will notify them any time a check is issued for covered damage after you file a claim.

Something you might not see on a home declaration page? The name of the insurance company from whom you think you are buying insurance. While this may seem odd, there’s no need to panic.

That’s because home insurance carriers have many different companies that write insurance on behalf of that company.

Named and additional insured

One important section of your homeowners insurance policy declaration page is the named insured section. This area lists the main individuals who are covered under the homeowners insurance policy, such as the primary owners who reside in the home.

Here, you’ll see any “named insured,” like the primary policyholder, as well as the “second insured,” who is typically a spouse or additional owner of the home. You may also have an additional insured — some may be listed like those individuals who have an interest in the home but are not extended coverage by the terms of the policy, such as unmarried partners or long-term roommates.

These people must be individually added to your insurance policy in order to be covered and listed on the dec page. It’s always a good idea to double-check this section if you have housemates or live with a long-term partner to ensure they’re adequately covered.

Coverage and policy limits

What is the primary purpose of a homeowners insurance declaration page? To quickly tell you about your selected coverage and limits.

All categories of coverage are included here, including:

-

Coverage A (dwelling coverage) — This protects the primary structure of your home and any attached structures.

-

Coverage B (other structures) — This coverage extends to eligible structures that aren’t attached to the home, such as a deck, detached garage, shed, fences, and more.

-

Coverage C (personal property) — This coverage provides protection for the contents of your home and any other personal belongings that you or your covered family members may own.

-

Coverage D (loss of use) — If your home is damaged by a covered event and deemed temporarily or permanently uninhabitable, this coverage can help you cover additional living expenses related to alternate housing, meals, storage, and other costs exceeding your basic living expenses.

-

Coverage E (personal liability) — This coverage protects you and your family members against liability if someone else is injured on your property or as a result of your actions.

-

Coverage F (medical payments) — If someone is injured on your property or a person in your home is found liable for injuring someone else, this coverage can help pay for things like medical bills.

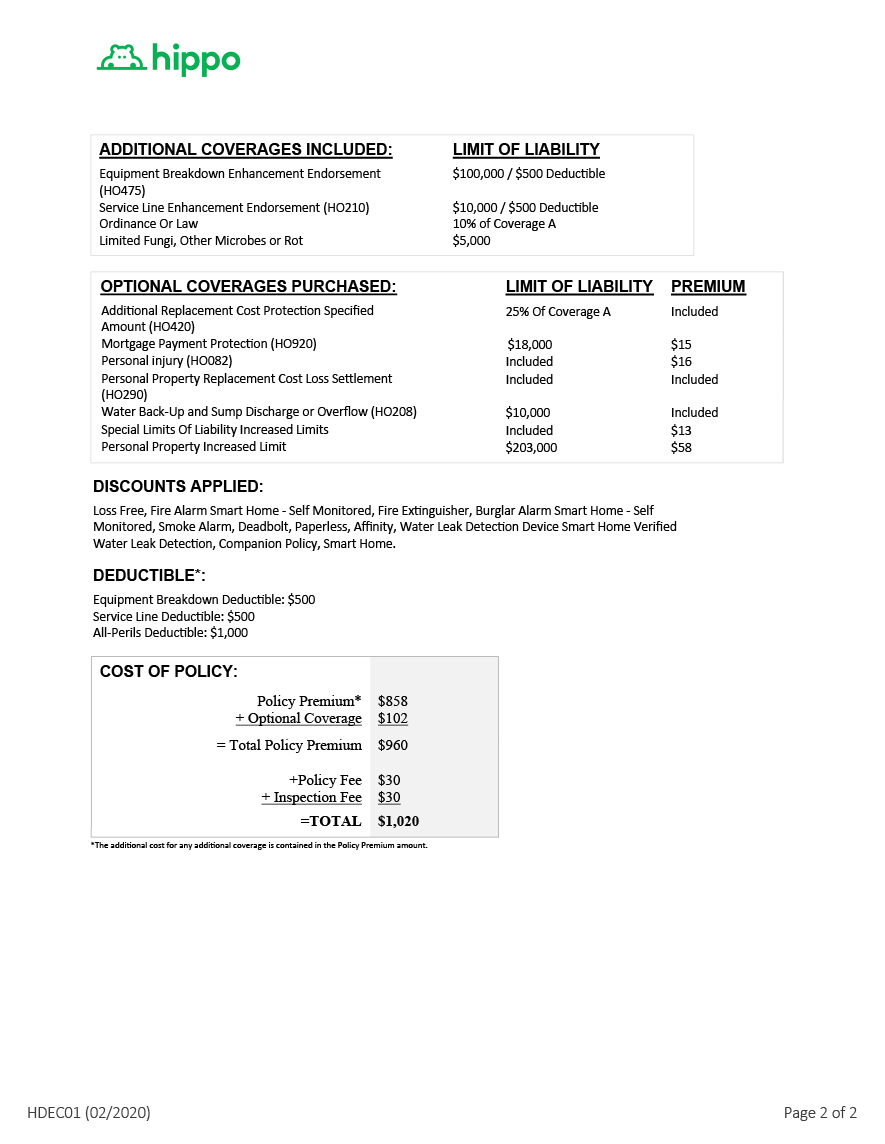

The coverage section of your declaration page will also spell out your policy’s homeowners insurance deductible limits. This is the amount you will need to pay out of pocket before your insurance provider steps in to cover the remaining cost (up to your policy limits). It will also note those policy limits or the maximum amount of coverage you will receive when filing an eligible claim.

Discounts

Insurance companies may offer various discounts to help you save money on premiums. If you are eligible for any of these available discounts, they will typically be noted on your policy’s declaration page or within your full policy documents.

While these will vary from one carrier to the next, typical homeowners insurance discounts include discounted pricing for:

-

Bundling multiple policies with one carrier (coverage for other homes, auto, life, personal property, etc.)

-

Installing smart home devices on your property

-

Paying your annual premium upfront and in full (versus making monthly premium payments)

-

Purchasing your policy completely online

-

Signing up for automatic payments

-

Being affiliated with certain organizations (including military discounts)

Don’t see any discounts listed on your declaration page? Make sure to ask your insurance agent which deals are available to you when renewing to get those added to next year's policy.

Endorsements and add-ons

When you purchase home insurance coverage, you have the option to add certain endorsements to your policy. These endorsements may help you better protect your home from perils that aren’t automatically included in your basic policy. Other add-ons expand your current coverage, such as increasing the policy limits for your personal belongings or dwelling protection.

Some common homeowners insurance policy endorsements include:

If you choose to add any endorsements to your policy, the breakdown of these (including your new policy limits) will be listed on your declarations page. This way, you can get a quick and comprehensive snapshot of everything you have covered. If you choose to add any additional endorsements throughout the year, you’ll automatically receive a new declaration page with this information added in.

What isn’t included

Now that you know what a homeowners insurance declaration page is, it’s important to note what it isn’t and what this document doesn’t include. While your homeowners insurance declaration page is a quick way to view what your coverage entails, it’s not nearly as extensive or detailed as the actual policy documents that follow.

Your policy documents will include a lot of information that your declaration page lacks. This includes a list of specific insurance exclusions for each category of coverage, any endorsements you have, the full policy application, and your actual insurance policy contract.

When you receive these documents, it’s important to read them thoroughly to ensure that you’re getting exactly what you intended from your policy. This will help you avoid any surprises and confirm that your premiums are going towards the protection you want.

Expert tips for home insurance declarations

When viewing your declarations page, there are a few steps you should take to secure your policy and make sure everything is in order.

-

Check for errors. Simple mistakes like misspelled names, incorrect addresses, or the wrong policy limits should be immediately updated to avoid issues when filing claims or paying your premiums.

-

Understand why you’re paying what you’re paying. Check the premium breakdown to see the total cost owed, including any taxes and fees. This can help you prepare financially for the actual cost, rather than just the base rate, and allows you to confirm that any discounts have been applied.

-

Safeguard your policy documents. Keep your declaration page and insurance policy packet in a safe, accessible place, like a fire-proof box or safe. You’ll need to refer to these pages when filing a claim or submitting proof of insurance.

-

Keep a spare. Ask for an electronic copy of the entire policy packet to keep as a backup.

Your declaration page serves as a summary of your policy, so don’t be afraid to check with your insurance provider if you aren’t seeing what you paid for or if there’s something different shown than what you wanted.

Trying to determine how much homeowners insurance coverage is right for you? Reach out to one of our friendly insurance agents to build the policy you need.

Still have questions?

Take a look at the most frequently asked questions about a homeowners insurance declaration page.

Where can I find my homeowners insurance declaration page?

Your declaration page is usually the very first page of your insurance coverage packet, whether it’s a homeowners insurance policy or other coverage like auto insurance or even life insurance.

Is a declaration page and a certificate of insurance the same thing?

While your policy’s declaration page and a certificate of insurance serve a similar purpose and contain much of the same information, they are not the same document. A declaration page is simply a summary of coverage and is intended to provide the policyholder with a quick reference sheet for the policy. A certificate of insurance, on the other hand, is an official document generated by the carrier to provide proof of coverage to other interested parties.

Do all insurance policies have a declaration page?

Generally, the first page of all insurance coverage packets is the policy’s declaration page. While this isn’t a legal requirement, this is almost always the case regardless of the type of policy purchased or the carrier.

How many pages are on an insurance declaration page?

Unless more than one page is necessary to list all of the relevant information, an insurance declaration page is typically just one single page.