2025 Dream Home Must-Haves: Practical, Flexible, and Built to Last

The American dream home is changing. Today’s homeowners are less concerned with excess and more focused on strategic decisions—both in buying a home and protecting their investment.

Our survey of nearly 2,000 current U.S. homeowners highlights this flexible mindset, revealing that the vast majority (93%) are willing to compromise to help secure a dream home. While many are open to giving up features like extra square footage or luxury upgrades, our data reveals that key dream home essentials (e.g., location and features that promote home protection) remain non-negotiable.

In addition to these dream home features, when it comes to considering their next move, current homeowners are leveraging their lived experience to make strategic decisions for greater long-term value.

Key takeaways

- Most homeowners are willing to compromise to attain their dream home, such as delaying major purchases (49%) or pausing travel plans (43%).

- While 39% of homeowners are open to buying a smaller property, only 22% would give up their desired location—even for their dream home.

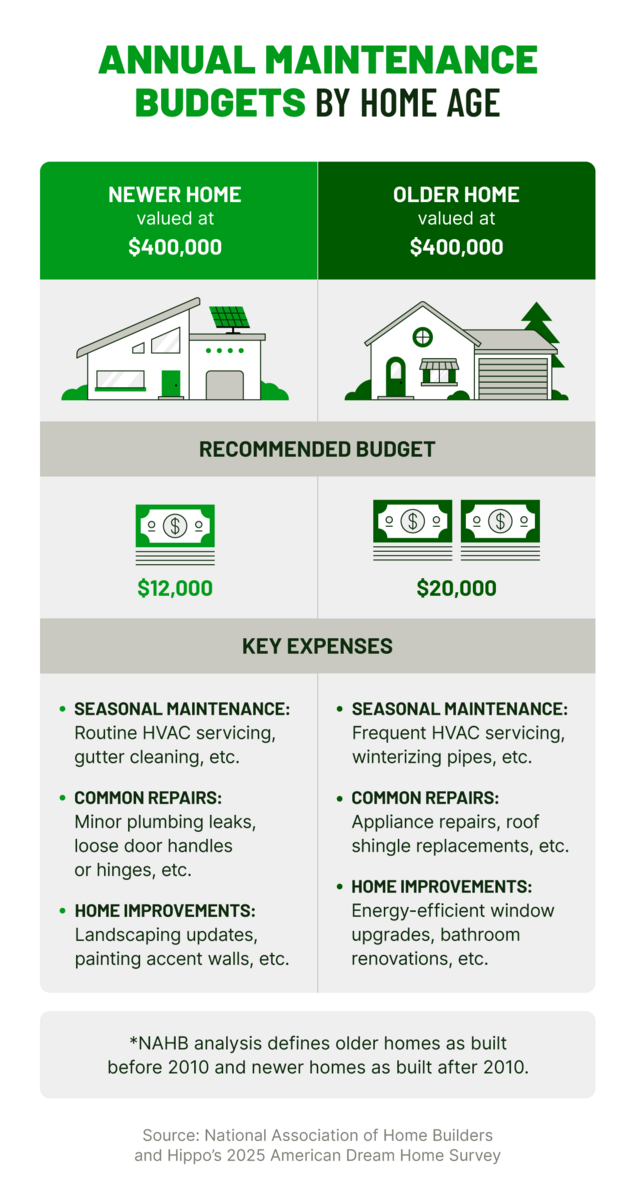

- Homeowners are more likely to invest in upgrades that provide long-term value and are less likely to take on a mortgage higher than their typical comfort level, or stretch their budget, to accommodate dream home features.

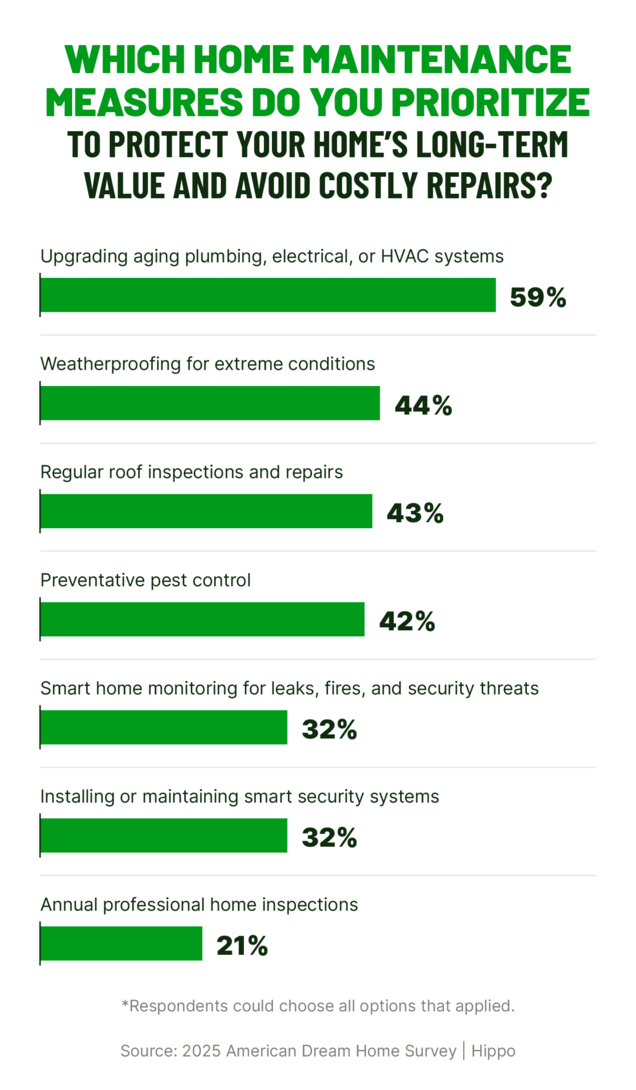

- When it comes to caring for their dream home after purchase, homeowners are thinking ahead. Over half (59%) prioritize upgrades to HVAC, plumbing, and electrical systems to help safeguard their assets and prevent costly repairs.

Dream home must-haves are centered around lifestyle and practicality

HOME FEATURES RANKED BY IMPORTANCE TO U.S. HOMEOWNERS |

|---|

1. A spacious backyard or outdoor space |

2. Move-in ready home with updated appliances |

3. Convenient access to good schools, transit, and local amenities |

4. Flexible, multi-use living spaces |

5. Home security and safety features |

6. Smart and sustainable home technology |

Top-ranked: Outdoor living space and move-in ready features

Mid-ranked: Convenience and flexible living spaces

Lowest-ranked: Smart and sustainable tech plus home security features

Dream home, realistic mindset: Homebuyers embrace sacrifice and flexibility

Dream home compromises: How men and women differ

The future of homeownership: Practicality and protection take center stage

HOME PROTECTION MEASURES RANKED BY IMPORTANCE TO U.S. HOMEOWNERS |

|---|

1. Updated HVAC, plumbing, and electrical systems |

2. A recently replaced roof or foundation upgrades |

3. Durable, weather-resistant construction |

4. Energy-efficient and climate-resilient upgrades |

5. A home warranty for unexpected repairs |

6. Smart security and home monitoring |

Future-proofing the American dream home

Download key survey findings

Methodology

Related Articles

Hippo Housepower Report: Home Protection Priorities in 2025

Understanding the Modern Homeowner: New Construction vs. Existing Homes

Critical Home Maintenance Upgrades: 5 Best ROI Home Improvements in 2024

Report: Where Homeowners Turn for Maintenance Advice in 2024

The Hippo New Homes Insights Report